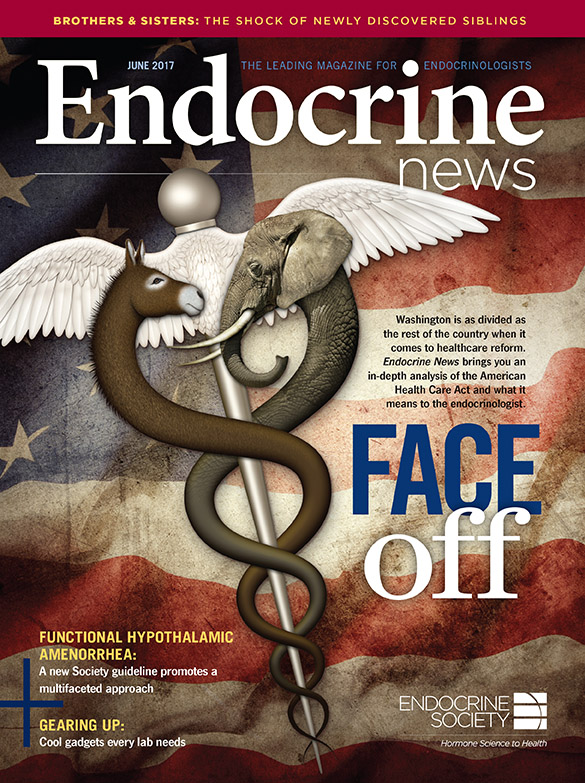

When the U.S. House of Representatives passed health reform legislation in yet another attempt to repeal Obamacare, there were more questions than answers. Endocrine News examines the new bill to let you know what’s in it, what’s not, what’s at stake, where the Endocrine Society stands, and what’s next for you and your patients.

On May 4, the U.S. House of Representatives narrowly passed H.R. 1628, the American Health Care Act (AHCA) by a vote of 217-213. The legislation, designed to repeal and replace the Affordable Care Act (ACA), also known as “Obamacare,” was the top priority of the Trump Administration and Republican congressional leadership.

During the two months prior to passage, the legislation went through numerous fits and starts, and in March it even appeared to be in jeopardy of never coming to a vote. However, a variety of changes were made to garner support of both conservative and moderate Republicans. The legislation now moves to the Senate where it faces a very uncertain future. Assuming united Democratic opposition, Republicans can afford to lose the support of no more than two of their senators to pass the bill. Already, many Republicans have expressed concerns with different aspects of the House legislation and some are calling for starting fresh, rather than work from the House proposal.

The health reform debate has been bitter, partisan, divisive, and confusing. It also has been fraught with misinformation.

The Endocrine Society has been a long-standing advocate for affordable and adequate health insurance. In preparation for the congressional debate, the Society identified key, non-partisan principles it believes should be incorporated into any proposal [See “Endocrine Society Core Principles for Health Reform Legislation” sidebar for details]. Because the AHCA does not meet the Society’s health reform principles and would make coverage more expensive – if not out of reach – for poor and sick Americans, the Society opposed the legislation.

The health reform debate has been bitter, partisan, divisive, and confusing. It also has been fraught with misinformation. Consequently, Endocrine News wanted to take a look at what was actually included in the legislation, where the Endocrine Society stands, and what is next.

Development of the AHCA

The original bill introduced on March 7 was passed through the House Energy and Commerce, Ways and Means, and Budget Committees. It then went to the Rules Committee prior to being considered by the House. On three different occasions, the House Rules Committee met and approved amendments to the bill that were incorporated into the text. For the most part, the major provisions of the AHCA as the bill stood on March 7 remain in the final bill, with some modifications reflected below:

- Repeal of Mandates – Repeal of the ACA’s employer and individual mandates (effective retroactively to Dec. 31, 2015). As an alternative to the individual mandate, AHCA imposes a one-year, 30% surcharge on the premium of an individual who has a break of more than 63 days in coverage.

- Refundable Tax Credits – Replacing the ACA tax credits and cost-sharing reductions with new refundable tax credits that vary by age for use by individuals who otherwise lack access to coverage (e.g., through an employer) and are phased out based on income. The credits do not vary by income (with lower-income individuals getting more in credits) and are not based on the cost of insurance in a given area.

- Repeal of Taxes – Repeal of the ACA’s various taxes, including the medical device, pharmaceutical, and health insurance taxes, as well as delay of the tax on high-value, employer-sponsored health plans (known as the “Cadillac” tax). Subsequent amendments accelerated the repeal of some of the ACA taxes, such as the repeal of the net investment income tax, to 2017 (from 2018), while further delaying the repeal of certain other taxes, such as an additional repeal delay of a year for the Cadillac tax and an additional delay from 2017 to 2023 of the 0.9% additional Medicare tax.

- Medicaid Expansion:

- Eliminates the mandatory ACA requirement for states to expand Medicaid to 133% of the federal poverty level (FPL);

- Sunsets the ability of states to cover above 133% of FPL as of Dec. 31, 2017;

- Preserves the ability of states to cover childless, non-disabled, non-elderly, non-pregnant adults at the state’s regular matching percentage;

- Grandfathers expansion enrollees enrolled prior to Dec. 31, 2019, at the 90% match rate for as long as they remain enrolled; and

- Limits enhanced federal match for grandfathered expansion enrollees to states that expanded as of March 1, 2017, thus prohibiting new states from expanding at the 90% match rate.

- Medicaid Reform:

- Implements in 2020 a per capita allotment funding approach across five beneficiary categories (children, blind and disabled, elderly, adults, and expansion adults);

- Allows a state the option to implement a block grant for specific populations (children and non-elderly, non-disabled, non-expansion adults);

- Repeals the ACA requirement that state Medicaid plans cover the entire essential health benefits (EHBs) packages, effective Dec. 31, 2019;

- Retains the repeal of hospital disproportionate share cuts for non-expansion states effective Fiscal Year (FY) 2018 and for expansion states effective FY 2020;

- Added a state option for a work requirement for non-disabled, non-elderly, non-pregnant adults, subject to certain requirements, effective FY 2017; and

- Repeals the cuts in Medicaid Disproportionate Share Hospital (DSH) funding.

- Safety-Net Funding for Non-Expansion States – Beginning in 2018, provides $10 billion in safety-net funding over five years to Medicaid non-expansion states. These states would receive an increased match rate of 100% for 2018-2021 and 95% in 2022 for services provided by safety-net providers. The allotment per state would be based on the number of individuals with incomes below 138% of FPL in the state in 2015, based on the American Community Survey.

- Federal Insurance Regulations – The bill does not repeal or alter many of the ACA’s regulations on commercial insurance, including coverage of preventive services without cost sharing, allowing dependents to remain on their parents’ policies up to age 26, no lifetime or annual policy limits, and medical loss ratio requirements. It did not alter the requirements for guaranteed issue and renewal, or the prohibition on pre-existing condition exclusions. AHCA did change the ACA limitations on age-based variations in premiums from a maximum of 3:1 to 5:1, but it did not eliminate the EHB requirement except with regard to Medicaid expansion enrollees. However, both the age-based premium and the EHB requirements could be impacted by the MacArthur Amendment (discussed below). That amendment could also impact the ACA’s prohibition on pricing policies based on the insured’s medical condition, which is otherwise not changed by AHCA.

- “Pro Life” Provisions – The bill cuts off Medicaid funding to Planned Parenthood for one year. It also does not allow the tax credit for purchasing insurance to be used on a plan that covers abortions.

Changes Made to the AHCA by Amendments & the Pre-existing Condition Debate

As noted above, a number of changes were made to the original bill after it was introduced. The key to ensuring passage was a compromise offered by Representative Tom MacArthur (R-NJ) that was further modified by an amendment by Representatives Fred Upton (R-MI) and Billy Long (R-MO).

Passage of the House bill is a significant step forward for Republicans to fulfill their promise to repeal and replace the ACA. However, the prospects for enactment into law remains tenuous.

Democrats and Republicans have made competing claims on whether the latest version of the healthcare bill maintains protections for people with pre-existing medical conditions. President Donald Trump has said, “Pre-existing conditions are in the bill. And I mandate it.” While Senator Charles Schumer (D-NY) has said that “insurance companies could deny coverage to those with pre-existing conditions.”

Neither of those comments quite gets it right. The latest version offers lesser protections than the Affordable Care Act, but it does not allow insurers to deny coverage to someone with a health condition.

The MacArthur amendment would allow states to apply for waivers from certain Affordable Care Act requirements for plans sold on the individual market, where those who buy their own insurance get coverage. Seven percent of the U.S. population, or 21.8 million people, are covered by health insurance purchased on the individual market.

The amendment calls for three waivers that would allow states to:

- Increase how much insurers can charge based on age –Under current law, insurers can charge older individuals up to three times as much as younger people. The American Health Care Act, beginning in 2018, would allow insurers to charge older people up to five times as much, and the amendment would allow the ratio to go even higher.

- Establish their own requirements for the essential health benefits –Insurers currently must abide by a list of 10 benefits mandated by the ACA, known as essential health benefits (EHB). The amendment would give the states the power to set their own EHBs, beginning in 2020.

- Allow insurers to price policies based on health status in some cases – The current law does not and the original bill would not allow insurers to set premiums based on health status. But the amendment would allow it for those who do not maintain continuous coverage, defined as a lapse of 63 days or more over the previous 12 months. Such policyholders could be charged higher premiums for pre-existing conditions for one year. After that, provided there wasn’t another 63-day gap, the policyholder would get a new, less expensive premium that was not based on health status. This change would begin in 2019, or 2018 for those enrolling during special enrollment periods.

Under Obamacare, insurers could not deny anyone coverage based on their health status, and the amendment does not change that part. The House-passed bill would retain the “requirement to guarantee issue coverage” — which means coverage must be offered regardless of health status — and it would retain the “prohibition on pre-existing condition exclusions” — which forbids insurers from excluding coverage specifically for a policyholder’s pre-existing conditions. But, a waiver would allow insurers to charge some with pre-existing conditions higher premiums.

Waivers & Stability Programs

The original AHCA bill said that insurers, again on the individual market, were required to charge a 30% higher premium for one year to those entering the market who didn’t have continuous coverage, defined as that 63-day lapse over the previous 12 months. The waiver, as proposed in the amendment, would enable states to instead allow insurers to price plans based on health status for those without continuous coverage. Consequently, consumers could be charged more than the 30% surcharge. States with such a waiver would also have to have either a “risk mitigation program,” such as a high-risk pool, or participate in a new Federal Invisible Risk Sharing Program designed to help those with high medical costs.

To facilitate these programs, the bill creates a Patient and State Stability Fund, with $100 billion in federal money over nine years and state matching requirements. States can apply to use the money for various purposes, including lowering out-of-pocket costs or setting up high-risk pools, which are state programs that cover high-risk individuals. Such pools existed in 35 states before the Affordable Care Act, and they typically keep individual insurance market premiums down by keeping the high-risk (and high-cost) individuals in their own pool.

While the media typically focuses on the divisions between the parties, disagreement and competitiveness between the House and Senate chambers can also be significant, even when both bodies are controlled by the same party. This is especially true around a seminal piece of legislation such as the AHCA.

Instead of setting up their own programs, states could also use a default reinsurance program, administered by the Centers for Medicare & Medicaid Services, which would pay a percentage of high-cost claims. An additional $15 billion would be used to set up the Federal Invisible Risk Sharing Program, another reinsurance program. (And $15 billion is set aside specifically for maternity and mental health coverage.)

A state applying for the waiver to allow some insurance pricing based on health status would have to use Patient and State Stability Fund money for one of those options: their own program, CMS’ default reinsurance, or the Federal Invisible Risk Sharing Program. What the waivers and stability programs would mean, however, for those with pre-existing conditions remains to be seen, as some analysts have predicted that health status underwriting could effectively make coverage completely unaffordable to people with pre-existing conditions.

To assist those with pre-existing conditions who find themselves facing higher premiums in waiver states, the Upton amendment provides an additional $8 billion from 2018 to 2023. In addition, the higher premiums for those without continuous coverage would only last one year, provided the policyholder continued to have coverage. If there was not another 63-day gap, the policyholder would get a new premium that was not priced based on health status.

There is another way that the waivers could impact not just those with pre-existing conditions, but anyone buying an individual market plan. The ACA’s EHB provision required insurance companies to cover 10 health services: ambulatory, emergency, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services and devices, laboratory services, preventive care and chronic disease management, and pediatric services including dental and vision. The House-passed bill, however, allows states to propose their own EHBs, beginning in 2020. As a result, individual market policyholders could see a change in what benefits their insurance policies have to cover and the dollar amounts of coverage under the waiver program.

Thus, President Trump’s claim that pre-existing condition protections were included in the House bill glosses over the fact that the bill weakens the ACA protections against higher premiums and less-generous benefit plans. Senator Schumer, meanwhile, was wrong to say that the bill goes “back to the day when insurance companies could deny coverage to those with pre-existing conditions.” Insurers would still be required to offer plans to anyone regardless of pre-existing conditions, although they could in some circumstances charge higher premiums based on health status.

Outlook for Legislation

Passage of the House bill is a significant step forward for Republicans to fulfill their promise to repeal and replace the ACA. However, the prospects for enactment into law remains tenuous. Now, it is the Senate’s turn to act. Its approach – both in process and substance – is expected to be dramatically different than that of the House for many reasons. Most senators serve broader constituencies than most House members. Further, the Senate process is different: The Senate utilizes an open-amendment process that gives the minority party the opportunity to be heard, and for this legislation, it must operate within budget reconciliation rules that allow the minority to strike provisions from the bill that do not meet the requirement to be directly budget-related. Finally, while the media typically focuses on the divisions between the parties, disagreement and competitiveness between the House and Senate chambers can also be significant, even when both bodies are controlled by the same party. This is especially true around a seminal piece of legislation such as the AHCA.

With only 52 Republican senators, and Vice President Mike Pence available to break a tie vote, it will be quite difficult to thread the needle of passage. There is a substantial and vocal constituency that is intensely opposed to the House-passed bill or any other bill to repeal the ACA.

It is to be expected that Senate Republicans will want to put their fingerprints on the contours of legislation to replace the ACA. If the margin of error in the House was narrow for AHCA passage, the margin in the Senate is razor thin. As in the House, it is unlikely that any Democrats will support legislation that aims to repeal the ACA. With only 52 Republican senators, and Vice President Mike Pence available to break a tie vote, it will be quite difficult to thread the needle of passage. There is a substantial and vocal constituency that is intensely opposed to the House-passed bill or any other bill to repeal the ACA. Following House passage, the chorus of voices – both pro and con – has grown even louder. As a consequence, many Republican and Democratic senators are likely to become more emboldened and entrenched in their respective philosophical and political viewpoints.

Mila Becker is the Chief Policy Officer at the Endocrine Society. She oversees the Government and Public Affairs Department and all advocacy and policy-related activities.

Information for this article was prepared by the Holland & Knight Healthcare Policy Team.